Hsinchu, Taiwan, R.O.C. – Macronix International Co., Ltd. (TSEC: 2337) today announced the unaudited financial results for the fourth quarter ended Dec. 31, 2018. All numbers were prepared in compliance with the TIFRS on a consolidated basis.

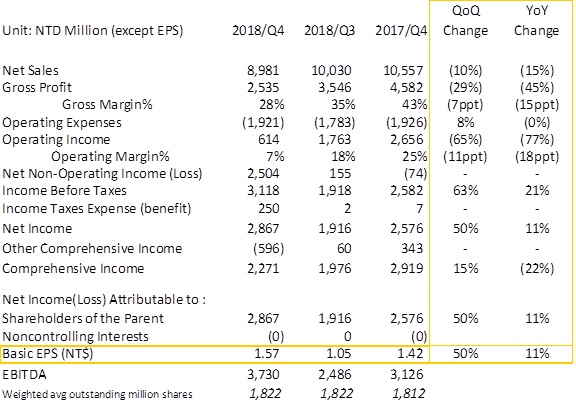

Summary of the Fourth Quarter 2018:- Net sales decreased 10% sequentially and decreased 15% over the fourth quarter 2017 to NT$8,981 million (US$291.3 million).

- Gross profit was NT$2,535 million (US$82.2 million) with 28% gross margin.

- Operating income was NT$614 million (US$19.9 million) with 7% operating margin.

- Income before tax was NT$3,118 million (US$101.1 million); net income was NT$2,867 million (US$93.0 million).

- EPS was NT$1.57; book value per share was NT$17.06.

Fourth-Quarter 2018 Financial Highlights: RevenuesThe Company announced the fourth quarter net revenues of NT$8,981 million (US$291.3 million), a 10% decrease sequentially and a 15% decrease year-over-year.

Gross Profit and Gross MarginsGross margin for the fourth quarter 2018 was 28%, lower than 35% in the third quarter 2018 and lower than 43% in the fourth quarter of 2017. Gross profit was NT$2,535 million (US$82.2 million).

Operating Expenses and Operating IncomeOperating expenses for the fourth quarter were NT$1,921 million (US$62.3 million), an increase of 8% sequentially and flat year-over-year. Operating income for the fourth quarter was NT$614 million (US$19.9 million), compared to NT$1,763 million in the third quarter of 2018 and NT$2,656 million in the fourth quarter of 2017.

Net Income and EPSNet income before tax was NT$3,118 million (US$101.1 million), compared to NT$1,918 million in the third quarter of 2018 and NT$2,582 million in the fourth quarter of 2017. For the fourth quarter of 2018, the income tax expense was NT$250 million (US$8.1 million), the net income after tax was NT$2,867 million (US$93.0 million). EPS was NT$1.57 (US$0.05), compared to NT$1.05 in the third quarter of 2018 and NT$1.42 in the fourth quarter of 2017. The book value was NT$17.06 per share.

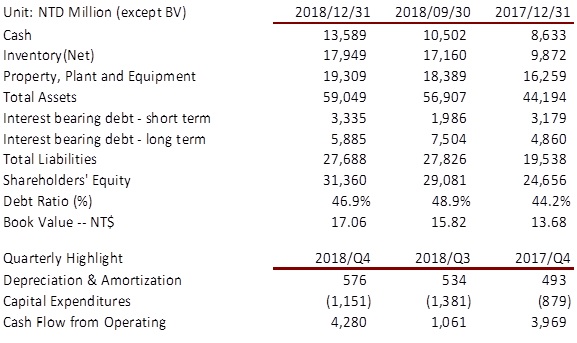

Current assets and cash flowThe debt-to-asset ratio is 46.9% which was lower than 48.9% in the third quarter of 2018. As of Dec. 31, 2018, the Company had NT$13,589 million (US$442.4 million) in cash and cash equivalents. Net inventory increased by NT$789 million to NT$17,949 million (US$584.4 million), compared to NT$17,160 million for the third quarter of 2018.

The total liabilities decreased to NT$27,688 million (US$901.4million), a decrease of NT$138 million, compared to NT$27,826 million at the end of Sep 30, 2018. Shareholders’ equity was NT$31,360 million (US$1,021.0 million). Depreciation and amortization expenses were NT$576 million (US$18.7 million) for the quarter. Net cash flow in operating activities was NT$4,280 million (US$138.8 million) in the fourth quarter. Capital expenditure for the quarter was NT$1,151 million (US$37.3 million) mainly for the procurement of production related equipment.

Business HighlightsFlash and ROM represent 51% and 44% of the Net Sales Respectively

Flash products accounted for 51% of net sales, a decrease of 36% year-over-year and a sequential decrease of 17%.

Sales in the fourth quarter from ROM revenue accounted for 44% of net sales, an increase of 50% year-over-year and a sequential increase of 1%.

Sales in FBG products accounted for 5% of net sales, a decrease of 35% year-over-year and a sequential decrease of 23%.

Quarterly Consolidated Statements of Income

*EPS is retro-adjusted

Consolidated Condensed Balance Sheet / Cash Flow

For details, please refer to the audited financial reports of 2018Q4.

Safe Harbor Statement

The statement contains certain forward-looking statements with respect to the results of operation, financial condition and current expectation. The forward-looking statements are subject to known and unknown uncertainties and risks that could cause actual results to differ materially from those expressed or implied by such statements.

Such risks and uncertainties include but are not limited to the impact of competitive products and pricing, timely design acceptance by our customers, timely introduction of new technologies, ability to ramp new products into volume, industry wide shifts in supply and demand for semiconductor products, industry overcapacity, availability of manufacturing capacity, financial stability in end markets, and other risks.

The forward-looking statements in this release reflect the current belief of Macronix as of the date of this release and Macronix undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such date

About Macronix International Co., Ltd.Macronix, a leading integrated device manufacturer in the Non-Volatile Memory (NVM) market, provides a full range of NOR Flash, NAND Flash, and ROM products. With its world-class R&D and manufacturing capability, Macronix continues to deliver high-quality, innovative and performance driven products to its customers in the consumer, communication, computing, automotive, networking and other segment markets.

For more information, please visit the Macronix's website: www.macronix.com

Contacts:

Douglas Sun

Macronix International Co., Ltd.

Finance Center / Investor Relations

+03 578 6688 ext. 76632

douglassun@mxic.com.tw